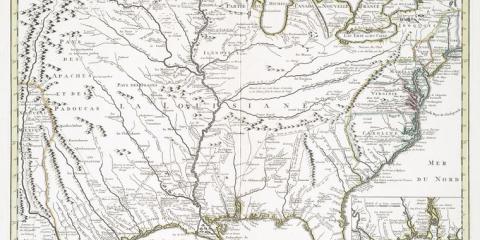

In 1720, everyday citizens converged on the banking streets of Paris, London, and Amsterdam, speculating in New World trading companies and other maritime ventures. By the close of that year, an unprecedented bull market would culminate in the world’s first international financial crash. Orchestrated by the insolvent governments of France and England, and fueled by illusions of colonial wealth, these investment bonanzas—henceforth known as the Mississippi and South Sea Bubbles—have remained synonymous with the temptations of get-rich-quick schemes and the dangers of herd behavior. Three centuries and many booms and busts later, their imprint is indelible. Not only did the bubbles accelerate the growth of a financial system overflowing with stock shares, newly created banknotes, and other mysterious paper devices imbued with financial alchemy—they also illustrated the power of trust and dread, faith and fear, as drivers of market volatility.

The works on display draw from the collections of The New York Public Library and include a trove of caricatures from a Dutch volume known as The Great Mirror of Folly (Het groote tafereel der dwaasheid). Published as the crisis was unfolding, these prints portray the bewildering forces of modern economic life. Loaded with jokes, often of a scatological nature, The Great Mirror of Folly lifts the curtain on a farcical political theater whose stars include bankers and statesmen—and that’s just for starters.

Offering tragicomic depictions of malevolent traders, hoodwinked investors, and villainous seductresses, the prints hold up a mirror to our own age, with its ever more complex monetary instruments and periodic meltdowns. They also reflect on the intersections between art and finance, reminding us that both are products of human imaginings.

This exhibition is organized by The New York Public Library and curated by Nina Dubin, Meredith Martin, and Madeleine Viljoen.